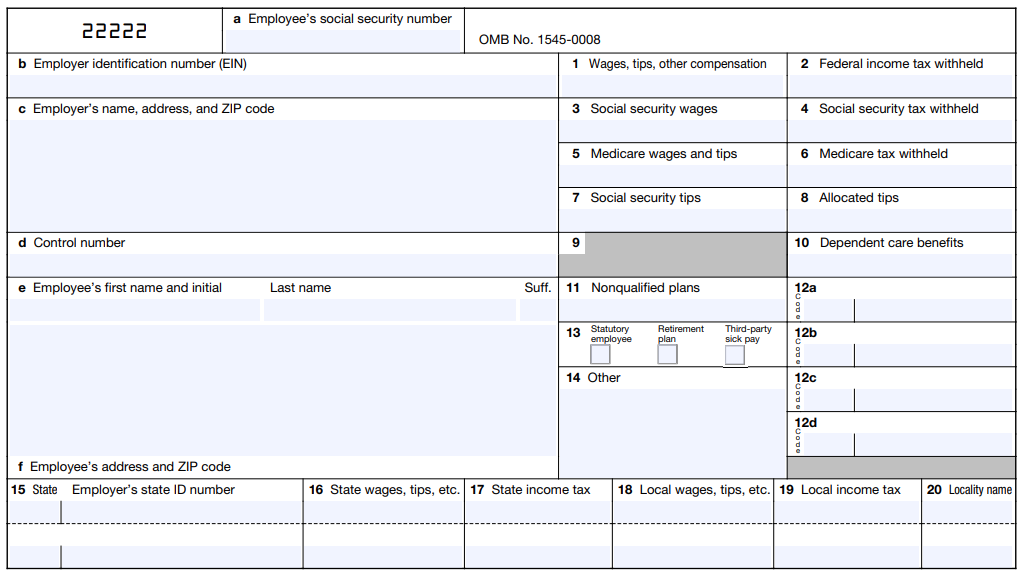

W2 Example 2024 Employee – For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, . Emily Kho is a seasoned writer with a specialization in B2B, EdTech and real estate. She has a Bachelor of Science from the prestigious William F. Harrah College of Hospitality at the University of .

W2 Example 2024 Employee

Source : sbshrs.adpinfo.comWhat’s a W 2? Wage and Tax Statement Explained | Paylocity

Source : www.paylocity.comKnow Your Form W 2: A Z

Source : sbshrs.adpinfo.comForm W 2, Wage and Tax Statement for Hourly & Salary Workers

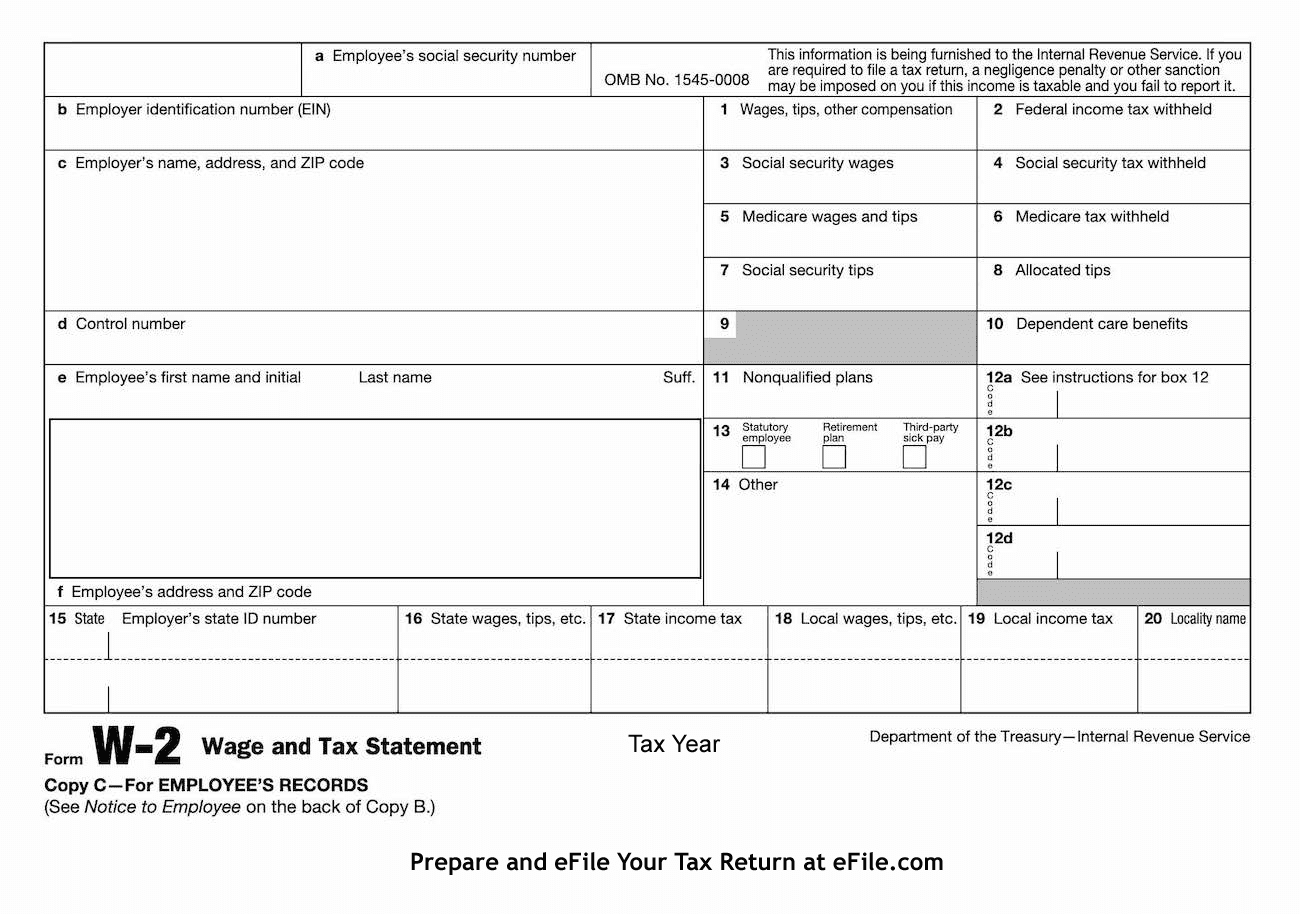

Source : www.efile.comW2 Form 2024 PDF: Printable Blank W 2 Template PDFliner

Source : pdfliner.comThe Ultimate Guide to W2 Form PDF [2024] WPS PDF Blog

Source : pdf.wps.comWhat’s a W 2? Wage and Tax Statement Explained | Paylocity

Source : www.paylocity.comHow to Create a W 2 for Your Nanny

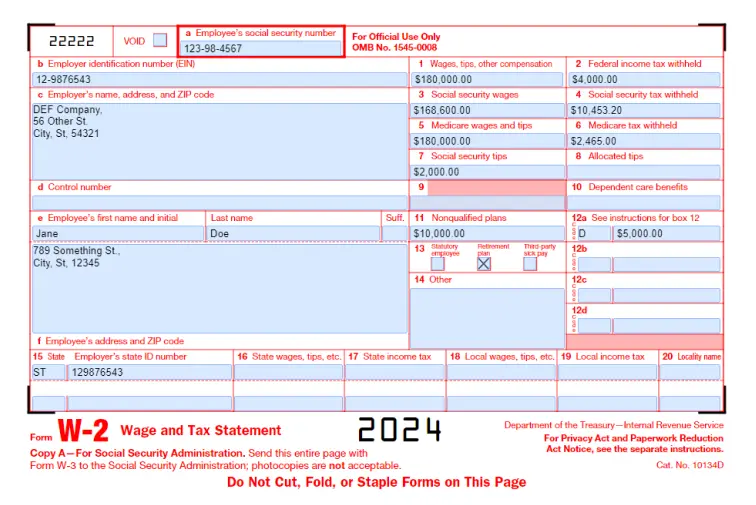

Source : gtm.comDeciphering 2024 W 2 Boxes and Instructions BoomTax

Source : boomtax.comThe Ultimate Guide to W2 Form PDF [2024] WPS PDF Blog

Source : pdf.wps.comW2 Example 2024 Employee Know Your Form W 2: A Z: This guide provides information on the different payroll tax forms and deadlines specific to household employers, helping you navigate the process with ease. . Which is the better payroll tool for your small business? We reviewed both systems to help you answer that question. .

]]>